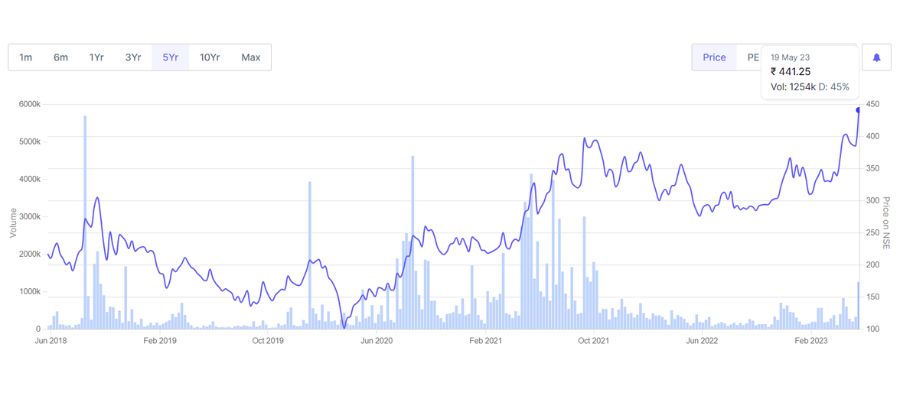

Stock price gained over 15% in a week; Touched an All-time-High of Rs. 451 per share on 18 May 2023

Ahmedabad (Gujarat) [India], May 20: The share price of Ahmedabad-based leading pharmaceutical company – Lincoln Pharmaceuticals Ltd made an all-time high. The share price of the company has gained more than 15% in a week and touched a high of Rs. 451 per share on 18 May 2023 with high volumes. The company’s share closed on May 19 at Rs. 440 per share on BSE. The market capitalisation of the company is around Rs. 880 crore.

In the last three years, the share price of the company has increased from around Rs. 150 per share to around Rs. 440 now – a gain of over 200%. In the last 1 month, the stock price has registered a gain of over 15% from Rs. 383 per share on 15 May 2023.

Over the last 5 years, the company has delivered a robust 20% CAGR in profits and higher single-digit growth in sales. The company has been reporting strong operational and financial performance and has managed to double its profit margins from around 9% in FY18 to over 14.5% in FY22. Strategic growth initiatives, product and geographical expansion, and operational efficiency are likely to contribute to growth going forward.

The liquidity position of the company is on a strong foundation, supported by healthy cash accruals, no-term debt, and healthy return ratios. Backed by improvement in the company’s financial risk profile, steady growth in scale & margins, and healthy profitability, rating agency ICRA has upgraded the company’s long-term and short-term bank facilities to A and A1, respectively.

Promoter groups and institutional investors have seen gradually increasing their stake in the company. Over the last few years, promoter groups have gradually increased their stake in the company. Promoter group holding in the company stands at 47% as on March 2023 from 32.36% in March 2020. Foreign institutional investors, too, have gradually increased their stake over the quarter and hold 1.27% as on March 2023.

In September 2021, the company acquired a plant in Mehsana, Gujarat, to launch Cephalosporin products. The company has invested Rs. 30 crores in the cephalosporin plant – including acquisition and subsequent capacity expansion using an internal source of funds. The plant is expected to contribute sales of around Rs. 150 crore in the next 3 years.

The company is reporting excellent growth in domestic and export operations and is expected to grow at a healthy double-digit in the years to come. The company currently exports to 60-plus countries and planning to enter the EU markets very soon.

For Q3FY23, the company reported a net profit of Rs. 21.61 crore – 22.8% growth YOY. Total Income in Q3FY23 grew 14.4% to Rs. 140 crore. For 9MFY23, the company reported net profit of Rs. 60.34 crore on a total income of Rs. 416.4 crore.

If you have any objection to this press release content, kindly contact pr.error.rectification[at]gmail.com to notify us. We will respond and rectify the situation in the next 24 hours.