Mumbai (Maharashtra) [India], August 06: Specialty chemicals company LANXESS completed the second-largest acquisition in its history on August 3 with the takeover of Emerald Kalama Chemical. The US-based specialty chemicals manufacturer was majority-owned by affiliates of private equity firm American Securities LLC. All required regulatory approvals have been received. The enterprise value of Emerald Kalama Chemical was USD 1.075 billion (EUR 900 million). After deducting liabilities, the purchase price was approximately USD 1.04 billion (EUR 870 million), which LANXESS financed from existing liquidity.

“Emerald Kalama Chemical gives us another major boost on our growth path. The new businesses are an optimal strategic fit for us. We are strengthening our position in markets with attractive growth rates and opening up new high-margin application areas, especially in the beverage and food sector or in cleaning and cosmetic products. What’s more, Emerald Kalama Chemical is perfectly backward integrated – strengthening our value chain in Consumer Protection. This segment is thus an important engine on the way to making LANXESS even more stable and profitable,” said Matthias Zachert, Chairman of the Board of Management of LANXESS AG.

“A strong team is now working at full speed to ensure a rapid integration.”

With the closing of the transaction, LANXESS grows by around

470 employees and the three production sites in Kalama/Washington (USA), Rotterdam (Netherlands), and Widnes (Great Britain).

In 2020, Emerald Kalama Chemical achieved global sales of approximately USD 425 million (EUR 375 million) and EBITDA pre exceptionals of around USD 90 million (EUR 80 million). Within three years, LANXESS expects an additional annual EBITDA contribution of around USD 30 million (EUR 25 million) from synergy effects. The acquisition will already be earnings per share accretive in the first fiscal year after its completion.

Expansion of the product portfolio for the consumer care sector

Around three-quarters of the sales of the acquired businesses are attributable to specialty products for the consumer care market.

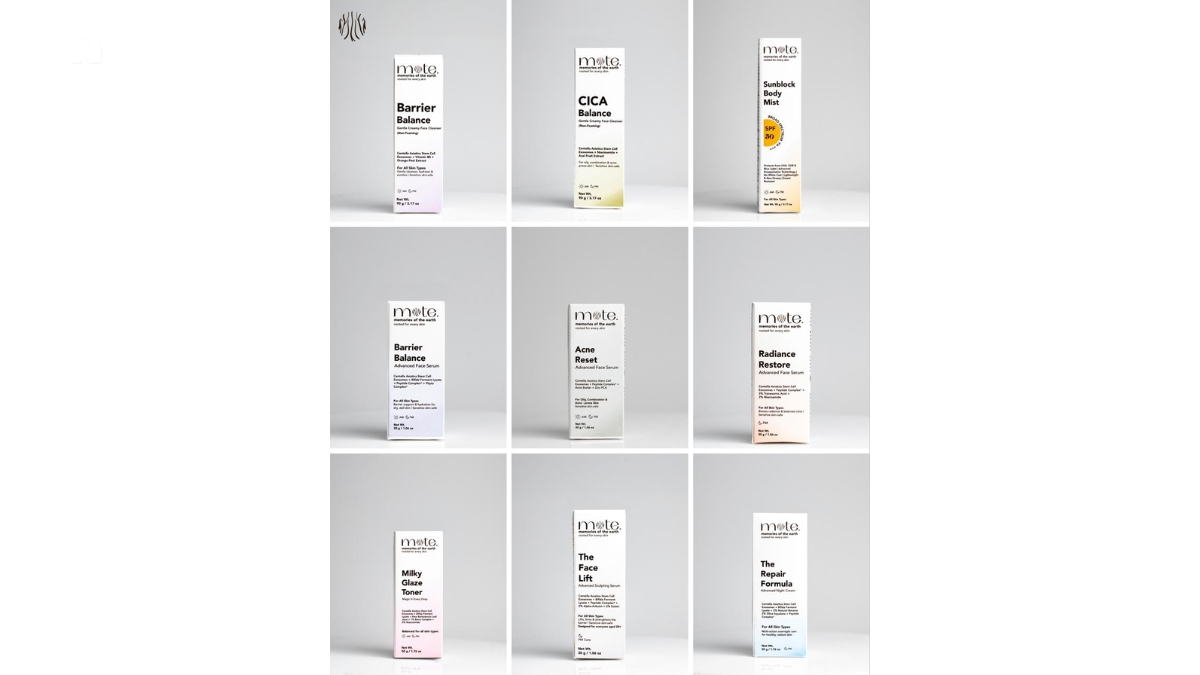

The acquisition makes LANXESS one of the leading providers of products for flavors and fragrances – an area in which the specialty chemicals company expects to see sustained strong growth rates. The substances are used primarily in personal care products, cosmetics, and exclusive fragrances, as well as food and beverages. The product range in the new LANXESS portfolio includes more than 30 aroma chemicals that provide earthy, floral, fruity, spicy, and herbal notes.

LANXESS is incorporating this business into the newly established Flavors & Fragrances business unit, which will become part of the Consumer Protection segment.

The acquisition also strengthens LANXESS’ leading position in the preservatives business. The new products will be used in high-growth applications in the food and beverage industry as well as in detergents, fabric softeners, cosmetics, and personal care products.

Specialty chemicals for industrial applications

Around a quarter of the sales of the acquired businesses are accounted for by specialty chemicals for high-growth industrial applications, primarily in the plastics, paints and coatings, and adhesives industries. The products will be integrated into the Polymer Additives business unit.